Explore the health insurance market size by demographics, type, service providers, and region, with forecasts up to 2027.

Health Insurance Market Size By Demographics, By Type, By Service Providers, By Geographic Scope And Forecast To 2027

Table of Contents

- Health Insurance Market Size By Demographics, By Type, By Service Providers, By Geographic Scope And Forecast To 2027

- Overview of the Health Insurance Market

- Market Size by Demographics

- Market Size by Type

- Market Size by Service Providers

- Market Size by Geographic Scope

- Case Studies and Examples

- Conclusion

Health Insurance Market Size By Demographics, By Type, By Service Providers, By Geographic Scope And Forecast To 2027

The health insurance market is a dynamic and essential sector of the global economy, providing financial coverage for medical expenses to individuals and mitigating the economic impact of health emergencies. This article explores the health insurance market, focusing on its segmentation by demographics, type, service providers, and geographic scope, with a forecast extending to 2027. Through detailed analysis and relevant case studies, we will provide a comprehensive overview of the trends, challenges, and opportunities within this vital industry.

Overview of the Health Insurance Market

The health insurance market encompasses a wide range of health coverage products and services designed to protect individuals from the financial risks associated with healthcare costs. Driven by factors such as increasing healthcare expenditure, aging populations, and growing prevalence of chronic diseases, the market is expected to witness significant growth over the forecast period.

Market Size by Demographics

Demographics play a crucial role in shaping the health insurance landscape. Key demographic segments include:

- Age: Different age groups have varying healthcare needs, influencing their health insurance coverage. For instance, the elderly typically require more comprehensive coverage due to higher risk of chronic diseases.

- Income: Income levels also affect health insurance coverage, with higher-income individuals more likely to afford private health insurance plans.

- Employment: Employment status influences access to employer-sponsored health insurance, a major coverage source in many countries.

- Gender: Gender-specific health issues, such as maternity and reproductive health, can dictate tailored health insurance products.

Understanding these demographic factors is crucial for insurers to design appropriate products and target the right segments.

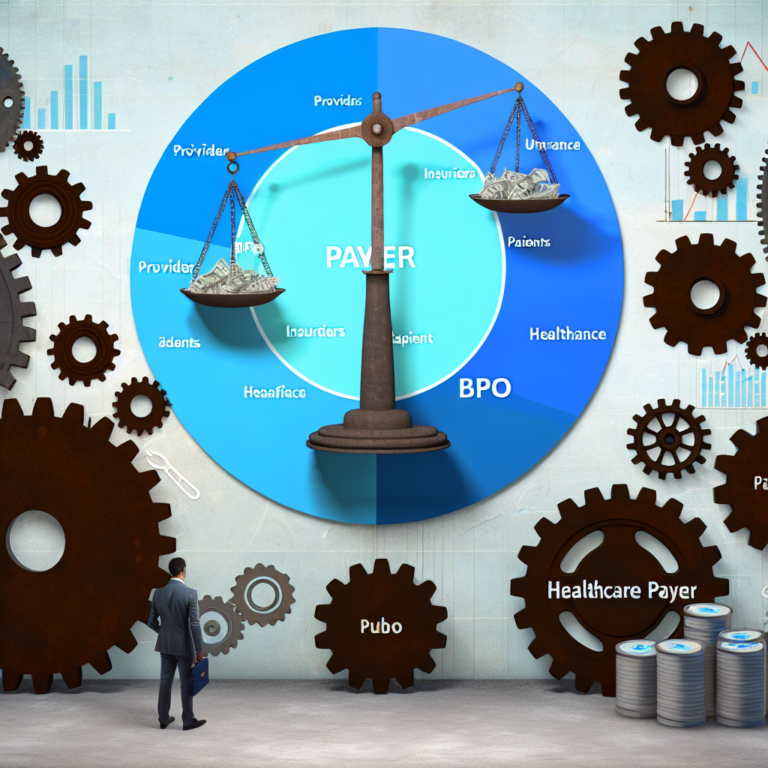

Market Size by Type

The health insurance market can be segmented by the type of insurance provided:

- Private Health Insurance: This includes plans purchased by individuals or provided by employers. Private insurance often offers quicker access to healthcare and coverage for a broader range of services.

- Public/Government Health Insurance: These are state-funded programs aimed at providing coverage to low-income individuals or certain groups like the elderly and veterans.

- Managed Care: These plans focus on maintaining the health of enrollees through preventive care and use of network providers.

- Others (including catastrophic health insurance): Designed to cover extreme medical costs, these plans have high deductibles and lower premiums.

Each type of health insurance has its own set of benefits and limitations, influencing consumer choice and market dynamics.

Market Size by Service Providers

Service providers in the health insurance market include:

- Insurance Companies: These are the primary providers of health insurance, offering a range of products from basic to comprehensive coverage.

- Health Maintenance Organizations (HMOs): HMOs offer plans that restrict members to a network of doctors and hospitals.

- Preferred Provider Organizations (PPOs): PPOs provide more flexibility in choosing healthcare providers compared to HMOs.

- Government Programs: Such as Medicare in the United States and the National Health Service (NHS) in the United Kingdom.

The choice of provider can significantly impact the costs and quality of care, making this a critical consideration for consumers.

Market Size by Geographic Scope

The health insurance market varies significantly by region, influenced by factors such as economic development, healthcare infrastructure, and government policies. Key regions include:

- North America: Highly developed healthcare systems and high per capita healthcare spending characterize this region.

- Europe: Strong government involvement in healthcare and extensive public health insurance systems are typical here.

- Asia-Pacific: This region is experiencing rapid market growth due to increasing economic development and healthcare reforms.

- Latin America and the Middle East & Africa: These regions are seeing gradual growth with increasing awareness about health insurance and government initiatives.

Understanding regional dynamics is essential for global insurers looking to expand their operations or enter new markets.

Case Studies and Examples

To illustrate the dynamics of the health insurance market, consider the following examples:

- Case Study 1: In the United States, the Affordable Care Act (ACA) significantly expanded public access to health insurance, impacting market dynamics by increasing the customer base for insurers but also introducing more regulations.

- Case Study 2: In India, the introduction of Ayushman Bharat, a government-sponsored health insurance scheme, aims to cover over 500 million people, significantly altering the health insurance landscape in the region.

These examples highlight how policy changes and government initiatives can drastically reshape market landscapes.

Conclusion

The health insurance market is influenced by a complex interplay of demographic factors, types of insurance, service providers, and geographic differences. As we look towards 2027, the market is expected to grow, driven by increasing global healthcare needs and technological advancements in healthcare services. For stakeholders in the health insurance industry, staying informed about these trends and adapting to regional differences will be key to capitalizing on emerging opportunities.

In conclusion, understanding the multifaceted nature of the health insurance market will enable insurers, policymakers, and consumers to make better decisions and improve health outcomes across different populations globally.