Explore insights into the U.S. health and medical insurance market, covering trends, growth drivers, and key industry players.

United States Health and Medical Insurance Market

Table of Contents

- United States Health and Medical Insurance Market

- Overview of the U.S. Health Insurance Market

- Key Players in the Market

- Types of Health Insurance Coverage

- Impact of the Affordable Care Act

- Challenges Facing the Health Insurance Market

- Technological Innovations and Their Impact

- Case Study: Impact of Telemedicine on Health Insurance

- Future Outlook

- Conclusion

United States Health and Medical Insurance Market

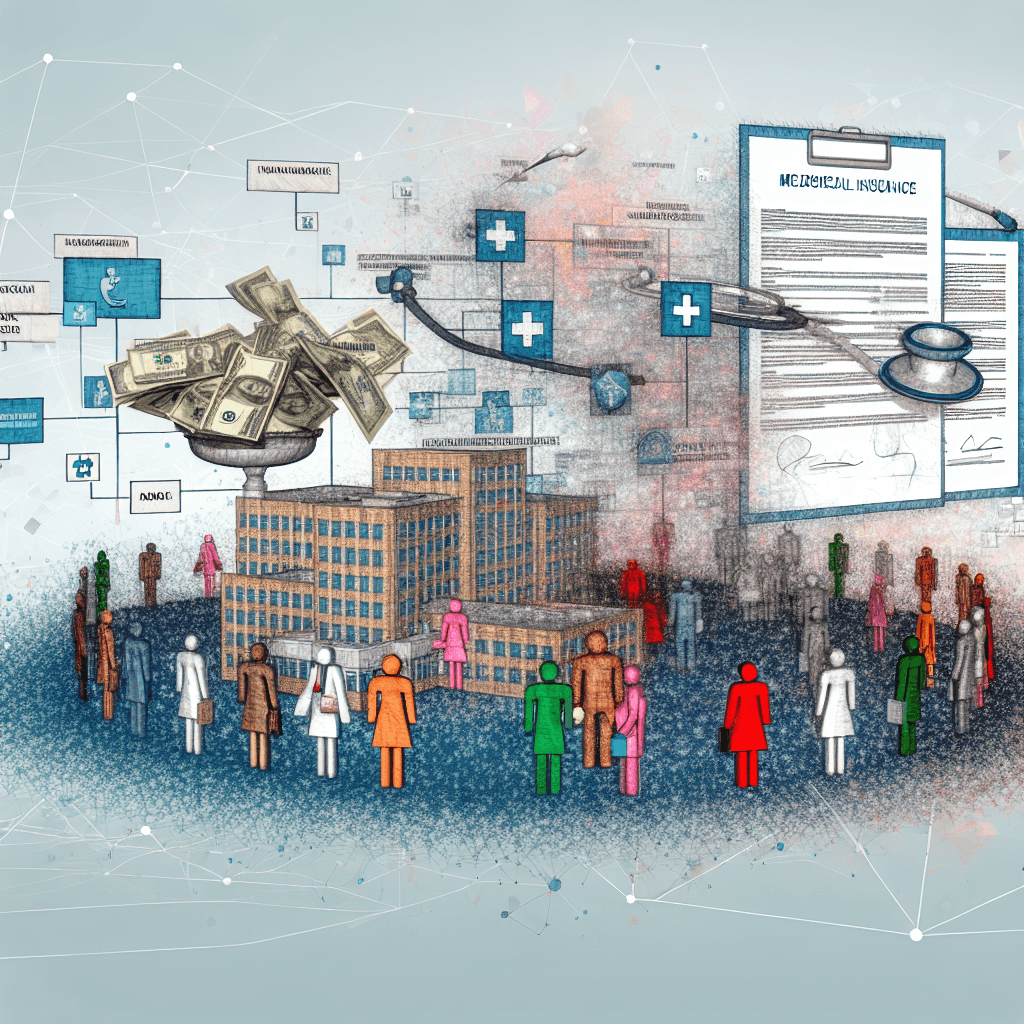

The health and medical insurance market in the United States is a complex and dynamic sector, pivotal to the nation’s economy and critical in ensuring access to healthcare for millions of Americans. This article explores the various facets of the U.S. health insurance industry, including its structure, challenges, and the impact of recent legislative changes. We will also delve into statistical trends and provide case studies to illustrate key points.

Overview of the U.S. Health Insurance Market

The U.S. health insurance market is characterized by a mix of private and public insurance programs. Private insurance is primarily provided through employers, while public insurance includes programs such as Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP). According to the Centers for Medicare & Medicaid Services (CMS), health spending in the United States grew by 4.6% in 2019, reaching $3.8 trillion, or $11,582 per person, and accounted for 17.7% of the Gross Domestic Product (GDP).

Key Players in the Market

The U.S. health insurance industry is dominated by several large insurance companies, including UnitedHealth Group, Anthem, Aetna, and Cigna. These companies not only provide a wide range of insurance products but also manage care services that aim to improve the quality of care while controlling costs.

Types of Health Insurance Coverage

- Employer-Provided Insurance: The most common type of health insurance, where coverage is provided through one’s employer.

- Individual Insurance: Purchased by individuals on the open market or through the Health Insurance Marketplace established by the Affordable Care Act (ACA).

- Medicare: A federal program that provides health coverage if you are 65 or older or have a severe disability, no matter your income.

- Medicaid: A state and federal program that provides health coverage if you have a very low income.

- Military Coverage: Including TRICARE and veterans health insurance.

Impact of the Affordable Care Act

The Affordable Care Act (ACA), enacted in 2010, brought significant changes to the health insurance landscape. One of its key provisions was the establishment of health insurance exchanges where individuals and small businesses can compare and purchase insurance plans. The ACA also expanded Medicaid eligibility and mandated that individuals have health insurance or face penalties, although the penalty was later set to $0 in 2019.

Since its implementation, the ACA has faced both praise and criticism. Proponents argue that it has expanded medical coverage to millions of uninsured Americans and provided consumers with more insurance options. Critics, however, contend that it has led to increased premiums and has imposed excessive regulatory burdens on businesses.

Challenges Facing the Health Insurance Market

The U.S. health insurance market faces several challenges, including high costs, regulatory complexity, and disparities in access to care. Health insurance premiums have been rising steadily, outpacing inflation and wage growth, which places a significant financial burden on American families and businesses.

Technological Innovations and Their Impact

Technology is playing an increasingly important role in the health insurance sector. Telemedicine, wearable health devices, and artificial intelligence (AI) are just a few examples of how technology is being used to enhance service delivery and patient care. These innovations not only help in managing costs but also improve the accessibility and quality of healthcare services.

Case Study: Impact of Telemedicine on Health Insurance

One notable example of technological impact is the rise of telemedicine, which has been significantly accelerated by the COVID-19 pandemic. Telemedicine allows patients to consult with healthcare providers remotely, which has proven essential during times of social distancing. Insurance companies have adapted by offering coverage for telemedicine services, which has facilitated continued access to healthcare while reducing costs associated with in-person visits.

Future Outlook

The future of the U.S. health insurance market will likely be shaped by ongoing legislative changes, technological advancements, and economic factors. The industry is expected to continue evolving in response to consumer needs and regulatory requirements.

Conclusion

The U.S. health and medical insurance market is a vital component of the nation’s healthcare system, providing coverage to millions of Americans. While it faces challenges such as rising costs and regulatory complexity, innovations like telemedicine and AI offer promising avenues for improvement. As the market continues to evolve, it will be important for policymakers, providers, and insurers to work together to ensure that all Americans have access to affordable and high-quality healthcare.

In conclusion, understanding the complexities and dynamics of the U.S. health insurance market is essential for navigating its future challenges and opportunities. By fostering an environment that encourages innovation and addresses systemic issues, the U.S. can continue to improve its healthcare system and the health insurance market that supports it.